FlexiCapital is an AMFI registered insitution engaged in the sale and distribution of wealth management products, including but not limited to Mutual Funds.Our range of services include a platform to provide products ranging from Corporate Deposits, Structured Notes, Insurance Products, Alternate Investment Funds, Portfolio Management Services , Equity Trading through Broking Services, Real Estate and Family office.

FlexiCapital provides investment services :

- On referral basis and

- As a distributor of third party Investment Products.

Our Value Added Services are specialised and thus we cater to the following services through our dedicated referral tie up's

- Family Office Services

- International Wealth Management Services

- Lending Solutions

- Tax Planning Services

- Private Equity and Venture Capital

- Foreign Exchange Management Consultancy in accordance with FEMA guidelines

Flexi Capital's mission is to serve clients with transparency, commitment to deliver and safeguard client's assets and interest at all times by providing financial services across the value chain. Our core activities is providing a robust and sustainable Wealth Management platform, Foreign Currency Exchange management and facilitating Lending Solutions. We are Flexi Capital, an institution connecting customers through innovation and simplicity.

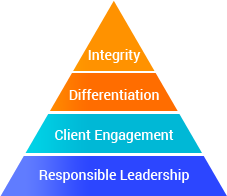

The four key values that guide

us as we perform our mission

Flexi Capital's mission is to serve clients with transparency, commitment to deliver and safeguard client's assets and interest at all times by providing financial services across the value chain. Our core activities is providing a robust and sustainable Wealth Management platform, Foreign Currency Exchange management and facilitating Lending Solutions. We are Flexi Capital, an institution connecting customers through innovation and simplicity.

Nasser Salim

Nasser Salim

Nasser is Managing Director of Flexicapital Pvt ltd. . He has over 20 years of investment and commercial banking experience including retail banking. He previously worked with Citibank (New Delhi; November 2004 to July 2016), and more recently as a Cluster Head Investments for Citi Private Clients. Prior to Citi, Nasser worked with ABN AMRO in the Retail Distribution Business (New Delhi; April 2004 to October 2004). Nasser's experience in investments, retail and commercial banking provides a unique advantage in terms of his industry knowledge for managing high net worth private banking clients.

Nasser managed a team of 12 Citigold and Citi Private banking executives with over USD 140 millionof assets under management, and continues to directly manage some very influential clients across industries.

Qualified for NCFM Certification in AMFI (Associations of Mutual Funds of India, Advisory Module) and IRDA (Insurance Regulatory and Development Authority, Certification in Insurance) in 2004. He is also associated with the Government of Uttar Pradesh as a Media Panelist for Economic Affairs representing them on leading news channels in India.

Nasser has received his MBA from Infinity Business School, Delhi, India (March 2004).He did his summer training with GE Countrywide in Six Sigma implementation in Gurgaon (May – June, 2003) Prior to his MBA, Nasser worked briefly with Reckitt Benckiser in marketing based out of Gurgaon. He holds a bachelor's degree in commerce from the University of Delhi.

Sanket Kapoor

Sanket Kapoor

Sanket is Managing Director of Flexicapital Pvt ltd. . He has over 17 years of investment and commercial banking experience. He previously worked with Citibank (New Delhi; September 2008 to July 2016) as a Relationship Manager – Investments and more recently as a Treasury/Business Counsellor for Institutional Clients. Prior to Citi, Sanketwas withwith ICICI Bank Private Banking (Mumbai; July 2007 to September 2008). Sanket's experience in investments, commercial banking, and capital raising for entrepreneurs provides a unique advantage in terms of his industry knowledge, network for sourcing deals, skills and resources for investment and treasury management.

Sanket managed over USD 50 million in assets at Citibank for high net worthindividuals and mid-size corporations. Sanket also managed currency portfolios for mid-size corporationswith a monthly flow of USD 20 million.

Qualified for NCFM Certification in AMFI (Associations of Mutual Funds of India, Advisory Module) and IRDA (Insurance Regulatory and Development Authority, Certification in Insurance)in 2008. He is currently pursuing Certified Financial Planner Certification from International College of Financial Planning.

Sanket has done his MBA from ICFAI Business School, Gurgaon, (June, 2007). He also has a bachelor's degree in Electronics Engineering from K.K. Wagh College of Engineering, Nasik, Pune University (July, 2001). Prior to his MBA Sanket has worked for 3 years in Engineering with IBM Business Process, Gurgaon, and Jindal Electrical and Machinery Corporation, Ludhiana.

Ankit Sehgal

Ankit Sehgal

Ankit is Managing Director of Flexicapital Pvt.ltd. . He has over 18 years of experience in the financial services industry across commercial and private banking. He was until very recently associated with Citibank (July 2006 to September 2016) most recently as a Senior Citigold Relationship Manager.

He was responsible for offering Citi's entire product suite to clients after researching and studying clients' risk profiles and needs, and then matching with clients' needs banking and investment products across assets, liabilities, commercial banking, and offshore banking. His wealth management product offerings included mutual funds, structured products/ equity-linked debentures, portfolio management services, foreign exchange, REITs, PE/ VC funds, and insurance products. He was managing the banking requirements of Citigold Clients, with a total relationship value of over USD 20 million.

He has regulatory certifications from the Association of Mutual Funds in India (AMFI), Insurance Regulatory and Development Authority (IRDA), National Stock Exchange (NSE; certifications in financial markets, derivatives and Securities), Commercial Banking, Industrial Banking and Client Excellence.

Ankit has done his MBA from NIS Academy (June 2006), and holds a bachelor’s degree in information technology from Sikkim Manipal University.