Foreign exchange risk (also known as FX risk, exchange rate risk or currency risk) is a financial risk that exists when a financial transaction is denominated in a currency other than that of the base currency of the company. Foreign exchange risk also exists when the foreign subsidiary of a firm maintains financial statements in a currency other than the reporting currency of the consolidated entity. The risk is that there may be an adverse movement in the exchange rate of the denomination currency in relation to the base currency before the date when the transaction is completed. Investors and businesses exporting or importing goods and services or making foreign investments have an exchange rate risk which can have severe financial consequences; but steps can be taken to manage (i.e., reduce) the risk.

Firms with exposure to foreign exchange risk may use a number of foreign exchange hedging strategies to reduce the exchange rate risk. Transaction exposure can be reduced either with the use of the money markets, foreign exchange derivatives such as forward contracts, futures contracts, options, and swaps, or with operational techniques such as currency invoicing, leading and lagging of receipts and payments, and exposure netting.. (Source: Wikipedia)

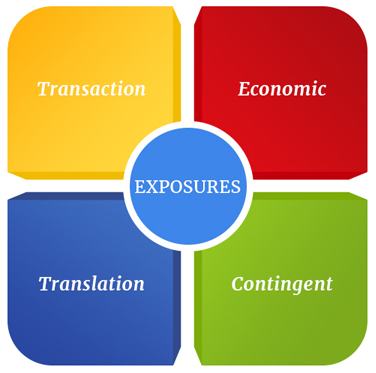

Some of the exposures that a firm may face are:

We at Flexi Capital will help our clients to understand the relevance of all such risks and exposures. We also provide a platform with all supporting data to understand and mitigate some of these risks.

Some of our Key Services include:

- Analyzing the various transaction charges levied on companies for various treasury functions offered by the dealer. This is compared with respect to the banking & industry standards.

- Evaluating the Exchange margins being charged on Spot / Forward transactions and recommending upon the same for optimum levels.

- Analysing various transactions related to charges which may be non recurring in nature but can have a significant impact on the overall charges paid to the dealer during the year.

- We would assist in Foreign Exchange rate negotiations with your dealer on a regular basis with providing full support on documents as required.

We will also help clients to understand the relevance of all charges to assess whether they are being overcharged or undercharged. This mechanism helps in maintaining complete transparency between the dealer and the client. It would help in removing the confusion related to the currency interbank rates which would lead to significant savings and improve profitability for the firms. In some cases, we have seen an increase of 25% to 30% of bottom line revenues.

The Foreign Exchange Management Act, 1999 (FEMA) is an Act of the Parliament of India "to consolidate and amend the law relating to foreign exchange with the objective of facilitating external trade and payments and for promoting the orderly development and maintenance of foreign exchange market in India".[1] It was passed in the winter session of Parliament in 1999, replacing the Foreign (FERA). This act makes offences related to foreign exchange civil offenses. It extends to the whole of India. replacing FERA, which had become incompatible with the pro-liberalisation policies of the Government of India. It enabled a new foreign exchange management regime consistent with the emerging framework of the World Trade Organisation (WTO). It also paved the way for the introduction of the Prevention of Money Laundering Act, 2002, which came into effect from 1 July 2005.

Flexi Capital will cover the following services under the Foreign Exchange Management Act

- FDI and ECB Services

- Valuation and Transfer of Shares (Resident and Non Resident)

- Assistance on Filing for Remittance of Funds (Overseas)

- Assistance on Filing for Current and Capital Account Transactions

- Facilitation on Export and Import Regulations

- Compliance Check on Foreign Exchange Regulations In India